Foreign Exchange LLC

Email: [email protected]

In trading currencies, market makers function as intermediaries in sales and purchases between two parties and two currencies. For example, a bank will function as a market maker when it collects sellers of the US Dollar to then sell to investors who have Euros in exchange. The value of each currency is based on the current market value.

To beat the MM you need to understand the basic objectives of their activity. Overall, the MM’s are traders and their objective is to make money. This includes strategies to trade against retails traders. The major difference between them and other traders is that they have the ability, through access to massive volumes, to move price at their will. So to make money, they aim to buy at a lower price and then sell at a higher price. They achieve this by:

1. Inducing traders to take positions.

This is achieved by using a range of price movements to ‘trick’ traders into taking a position in a given direction but then reversing it again. This means that the MM can sell a specific currency at a certain price and then buy it back at a lower price when the retail trader feels too much pain from the currency value moving backward and wanting to sell it back again (e.g. via the stop loss)

2. Create panic and fear to induce traders to become emotional and think irrationally. This often involves :

⋅ quick moves

⋅ spike candles

⋅ news releases

⋅ ‘inexplicable’ price behavior.

3. Hit the Stops and Clear the Board.

This forces traders into ‘margin trouble’ and ultimately out of the game.

Even though they have a number of tools at their disposal, they do have some restrictions imposed on them from outside authorities. These include:

1. The IMF restricts their ability to move price to a general range so as to avoid a collapse of the market.

2. This is generally limited to the ADR and will involve moves of as much as 200 pips per day in most pairs.

3. They do not have unlimited equity so it is necessary for the market- makers to close positions and regain balance periodically.

The only tools they have are to be able to buy or sell currency in different volumes at different prices. By doing this strategically, they can :

1. Entice traders to take positions by providing evidence that price is or is going to move in a certain direction.

2. Appeal to the emotional side of traders by changing the character and speed of price changes.

3. Once the trap has been set, and the bait taken, cause the price to move in such a way as to cause price to move against the traders, allowing the banks to buy currency back from or sell currency back to the traders so that they are square again.

4. This means that the trader has entered the market by buying currency from the bank at a given price and exited the market by selling back to the bank at a lower price. Conversely, the bank has sold to the trader at the higher given price and bought back from the trader at the lower price.

While these price movements are used to trap traders into unfavourable positions, they are not used 24 hours a day, but will be used more at certain times. The patterns are most commonly observed in the following time

periods :

1. The beginning of the season (quarterly)

2. The beginning of the week (Sun/Mon)

3. The beginning of the day

4. The beginning of the session

5. The end of the session

6. The end of day

7. The end of the week

8. The end of the season.

In addition to move price MM's can take advantage of "sentiment" which develops as a result of news releases of varying types. Sometimes immediate price movements are designed and used to "cover-up" the MM is price movement. The rumour mill also has a role to play in generating a public expectation of price movement. It is not uncommon to see the general news being particularly pessimistic for example about a particular currency only to see the currency rise against it but usually after people have been trapped in line with the sentiment.

Brokers and dealers have mechanisms available to them for manipulating price to enable the process of taking money from traders, who are also their clients !

Usually, trader’s transactions are dealt with ‘in house’ and never make it to the interbank market so it is very easy for them to manipulate price to their own advantage. They have a number of additional tools at their disposal and include :

1. Requoting

2. Trigger all stops in a given price range (which is part of the dealers

functions in the MT4 platform)

3. Vary the spread (which is why scalping methods often fail) at times

when it is an advantage to them to do so.

4. Throw a price spike to take stops out, bear in mind that they know

where the stops are.

5. Target traders who are in margin trouble and move price against

their positions to “finish them off”. Again bear in mind that they know who is in trouble because it is part of their backend platform.

To successfully use the market maker method you need to begin to understand the motivations and tools that the MM has. The sole goal of the MM is to make a profit. The only tools at its disposal relate to manipulating price.

Price is a reflection of the number of transactions and the price paid for these transactions. A large number of transactions are required to shift the price. The Forex market is said to trade $4,000,000,000,000 per day. The bulk of the transactions are carried out by large institutions, not by small traders.

Therefore, the bulk of transactions made by small traders will be made with larger institutions. This also means that a price is moved predominantly as a result of what the large institutions are doing with currency. Their ability to dominate the market is overwhelming. It costs about 10,000 lots to move the market by one pip. MM’s have the ability to move price at will retail traders do not. So for a retail trader to be truly successful, they need to at least have a concept of this process so that they understand what is happening and why. Even better, to be able to identify the patterns and strategies that MM’s use to play the game and to the ‘piggy back’ with them rather than attempt to trade against them.

For example, if one institution places an order to buy $1,000,000,000 (10,000 contracts) of Euro for instance, then it would require 10,000 traders selling one contract each, 100,000 traders sell 0.1 contracts each or 1,000,000 traders selling .01 contracts each to balance these transactions. Put another way, the same number of traders would be required to initiate a transaction at more or less the same time in the same direction to move the market.

So once you realize that price is moved as a result of deliberate, logical decisions the idea that price is a product of the emotional feeling of the various traders involved or of sentiment is misguided. Retail traders then, are left to react to the prices that they see, many of whom react emotionally.

In relation to learning and using this material, it involves changing the way you think about the market and it will be necessary to do the homework, absolutely essential to learn to spot the patterns. You won’t be able to see them setting up if you can’t see them in hindsight.

Even after you are proficient, it will still be worthwhile going through setups on historical data to ‘keep your eye in’.

Most of the successful students go through at least several years’ worth of charts to identify the patterns.

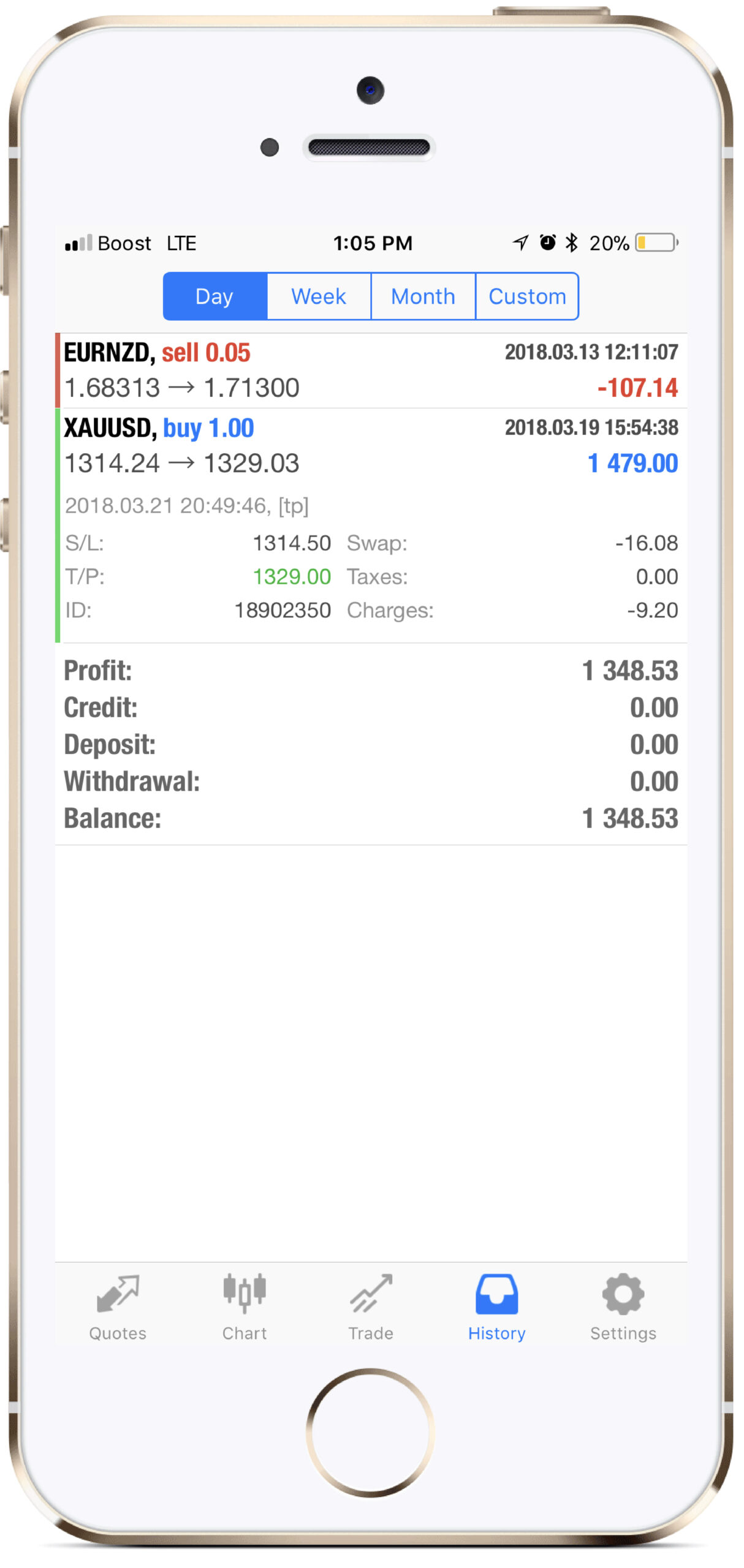

Trading should be reasonably relaxing rather than stressful. So rather than trying to trade everything that moves aim to be extremely selective and then make as much as you can from that move. This of course involves trading heavily on these highly selected setups.

Knowledge is not everything in trading, in order to become financially independent you also require a huge capital. Our education program comes with funding upon graduation. You’ll receive $50K-$100K in funding from us where you will need to show us your profitability and consistency in your first 3-6months in order to qualify.